Getting onto the property ladder in Manchester can feel a bit out of reach at times, especially with prices rising across the region. That said, there are still pockets of the city and surrounding areas where first-time buyers are finding real value.

Using the latest figures from the Office for National Statistics (ONS), published on 21st May 2025 and in no order, we’ve taken a closer look at some of the most affordable areas to buy a home.

These are places where average prices remain lower, giving you a better shot at finding something that fits your budget.

Whether you’re just starting to think about home ownership or already deep into your search, this guide explores where your money might stretch further.

1. Oldham

Avg. House Price:

£206,000

Avg. First Time Buyer Paid:

£188,000

Property Prices in Oldham

Oldham has an average house price of £206,000, with first time buyers typically paying closer to £188,000.

It’s a sensible choice if you’re keeping an eye on your budget. While prices there have crept up in recent years, they still sit well below what you’d expect to pay closer to the city centre.

What Will a Deposit Look Like?

For a home priced at the typical first-time buyer level of £188,000 in Oldham, a 5% deposit would come in at around £9,400.

If you’re aiming for 10%, that moves closer to £18,800, while a 15% deposit would be roughly £28,200. These figures are just a guide, of course.

What you’ll need can vary depending on the lender, your credit score and the type of property you’re looking to buy.

Types of Homes You’ll Find

Oldham offers a broad mix of homes that can appeal to first-time buyers, with traditional terraces found throughout the town and newer developments popping up in surrounding areas like Chadderton and Lees.

There are also some more budget-friendly pockets around places such as Hollinwood and parts of Royton, where prices often sit below the town’s average. These areas can be especially attractive if you’re working with a tighter budget.

Older terraces tend to be the most competitively priced, although they may need a bit of updating or come with certain conditions that could influence your mortgage options.

In neighbourhoods like Saddleworth, the housing stock shifts to more character homes and cottages, which carry a bit more charm, and often a higher asking price. That said, some surrounding villages still offer better value if you’re open to being slightly further out.

It’s worth knowing how the type and age of a home might affect your mortgage application. Older properties or those needing work can sometimes limit which lenders are open to you, while brand new homes might be priced a little higher, which could impact how much you’re able to borrow.

Thinking About Buying in Oldham?

If you’re weighing up whether Oldham could be the right place for your first home, our mortgage advisors in Oldham can help you understand how much deposit you’ll need, what types of mortgages might be available, and which properties are most likely to suit your budget.

Moving to Oldham?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

2. Salford

Avg. House Price:

£217,000

Avg. First Time Buyer Paid:

£200,000

Property Prices in Salford

he average home here is priced around £217,000, with first-time buyers typically paying closer to £200,000. That balance of accessibility and opportunity is one of the reasons Salford continues to be a popular choice for those buying their first home.

What Will a Deposit Look Like?

If you’re buying at the average first-time buyer price of £200,000 in Salford, a 5% deposit would work out at £10,000. Going up to a 10% deposit would take you to £20,000, while a 15% deposit would be around £30,000.

These figures are estimates and should only be used as a rough guide. Your deposit requirement could be higher or lower depending on your financial circumstances and the property itself.

Lenders consider things like your income, credit history, and the type of property when calculating what’s acceptable. Using a mortgage calculator can help you build a more realistic picture of your borrowing power.

Type of Homes You’ll Find

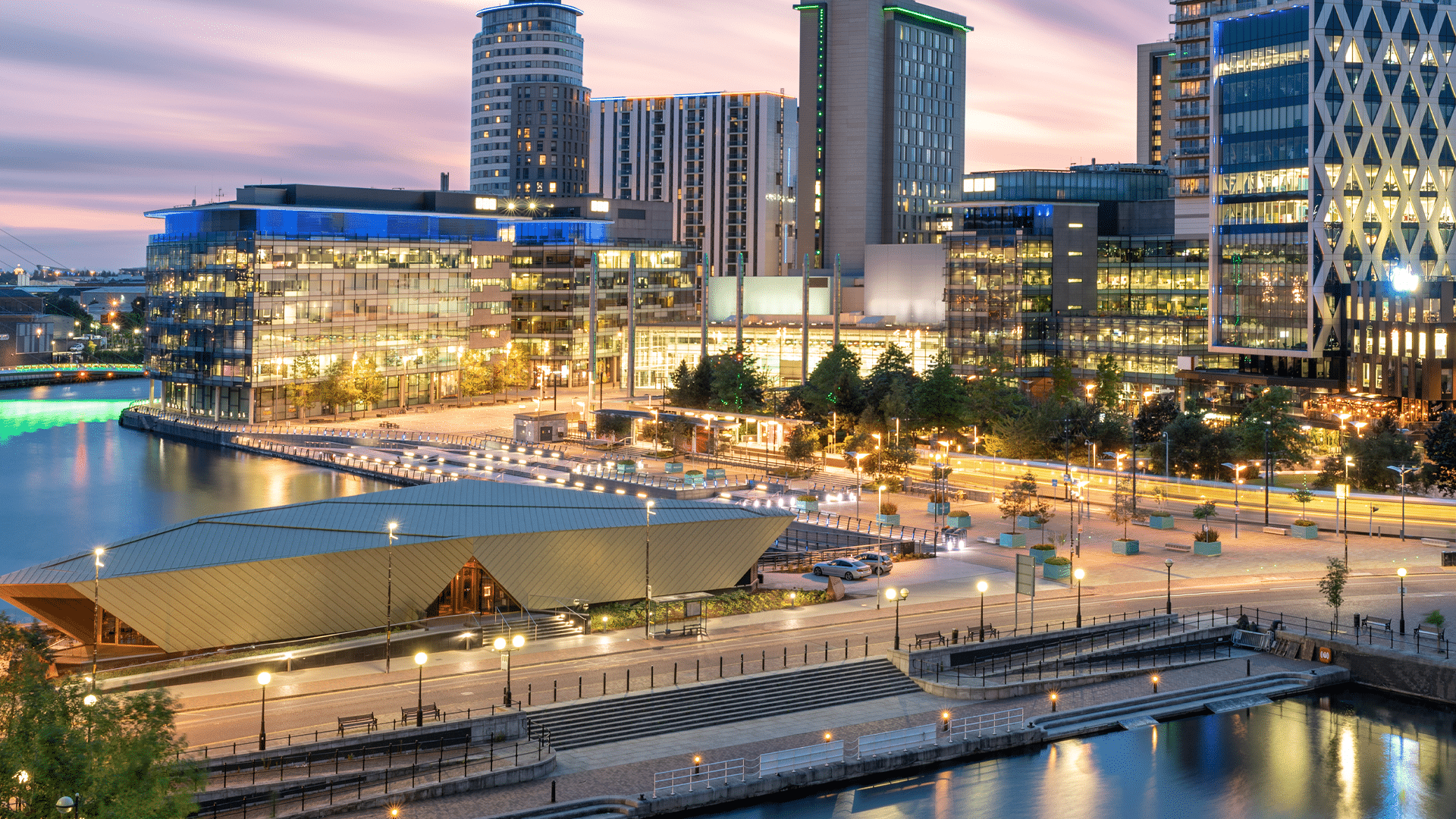

There’s a real variety of housing in Salford, which is part of what makes it so appealing to different kinds of buyers. In areas like Eccles and Swinton, you’ll find traditional terraces and semis that are often more affordable than properties closer to the city centre.

The Quays area, on the other hand, has a growing number of modern apartments, popular with young professionals and first-time buyers after something low maintenance and well-connected.

Some of the older properties might offer more space and value, though they may need updating or could come with conditions that affect your borrowing options. Meanwhile, new developments continue to expand around Salford, offering fresh choices for buyers looking for something more modern.

Thinking About Buying in Salford?

If you’re considering Salford as a potential area to buy your first home, our mortgage advisors in Manchester can walk you through how much deposit you might need and what sort of lending options could be available for the type of property you’re looking at.

Moving to Salford?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

3. Wigan

Avg. House Price:

£189,000

Avg. First Time Buyer Paid:

£171,000

Property Prices in Wigan

Wigan stands out as one of the more affordable areas in Manchester. With an average house price of around £189,000, and first-time buyers typically paying closer to £171,000.

What Will a Deposit Look Like?

If you’re buying at the average first-time buyer price of £171,000 in Wigan, a 5% deposit would be around £8,550. A 10% deposit would come to £17,100, while going up to 15% would mean setting aside roughly £25,650.

These numbers are only a guide, and the actual amount you’ll need will depend on your credit profile, the property you choose and the lender’s criteria. Mortgage calculators are a good place to begin understanding what’s realistic for your budget.

Type of Homes You’ll Find

Wigan is packed with traditional housing, especially in areas like Ince, Hindley and Ashton-in-Makerfield. Red brick terraces are common and can offer surprisingly generous living space, often at a lower cost than similar homes in other parts of the region.

You’ll also find a strong supply of semi-detached homes, many of which come with decent gardens and off-road parking, making them a favourite with buyers planning to stay for the long term.

In recent years, several new-build estates have sprung up around the town, offering modern family homes with better energy efficiency and lower running costs. These tend to come in at a slightly higher price, but they can be ideal if you’re after something that’s ready to move into.

Thinking About Buying in Wigan?

If you’re looking at Wigan as a potential place to buy, our mortgage advisors in Manchester can help you understand how your deposit and income could shape your mortgage options based on local property trends.

Moving to Wigan?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

4. Harpurhey

Avg. House Price:

£148,800

Avg. First Time Buyer Paid:

£132,900

Property Prices in Harpurhey

With an average house price around £148,800, and first-time buyers typically paying closer to £132,900, it’s an area that appeals to those looking to get onto the property ladder without stretching their budget.

Harpurhey has changed a lot in recent years, with ongoing investment bringing new life to the area while keeping it affordable for first time buyers.

What Will a Deposit Look Like?

For a first-time buyer purchasing at the average price of £132,900 in Harpurhey, a 5% deposit would amount to approximately £6,645. Opting for a 10% deposit would require around £13,290, while a 15% deposit would be about £19,935.

These figures serve as general estimates, actual deposit requirements can vary based on factors such as the lender’s criteria, your credit history, and the specific property you’re interested in.

Type of Homes You’ll find

Harpurhey predominantly features traditional red-brick terraced houses, many of which date back to the early 20th century. These homes often offer generous living spaces and are popular among first-time buyers seeking value.

In addition to terraces, the area includes several semi-detached properties, particularly in estates like Kingsbridge and Shiredale. These homes typically come with gardens and are suitable for growing families.

Recent years have also seen the development of new-build homes, provided modern living options while still benefitted from the area’s affordability.

Thinking About Buying in Harpurhey?

Harpurhey presents an excellent opportunity for first-time buyers looking for affordable housing within close proximity to Manchester city centre.

If you’re considering a move to the area and would like to discuss your mortgage options, our team of mortgage advisors in Manchester are here to help you navigate the process.

Moving to Harpurhey?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

5. Little Hulton

Avg. House Price:

£164,000

Avg. First Time Buyer Paid:

£152,000

Property Prices in Harpurhey

With the average home priced at around £164,983, and first-time buyers typically spending closer to £152,000, it stands out as one of the more affordable spots for buyers looking to step onto the ladder.

It’s a well-connected area that offers decent access to both Manchester and Bolton, while still giving you room to breathe and a bit more space for your money.

What Will a Deposit Look Like?

If you’re buying at the average first-time buyer price of £152,000, a 5% deposit would come in at around £7,600. A 10% deposit would be £15,200, while going up to 15% would mean setting aside roughly £22,800.

These figures are just a guide. What you’ll actually need could vary depending on the lender, the property itself and your credit history.

Type of Homes You’ll find

Little Hulton mainly features mid-century semis and rows of brick-built terraces, many of which come with gardens and off-road parking. These homes tend to offer more space than what you might find in more central parts of Manchester, and they often come at a lower price too.

There are also a few newer developments dotted around the area, which offer modern layouts and better energy efficiency. While these newer homes might cost a little more, they can be a good fit if you’re after something that’s move-in ready.

Thinking About Buying in Little Hulton?

Little Hulton is a popular choice with first-time buyers looking for more space without paying over the odds. If you’re thinking about making the move, our mortgage advisors in Manchester can help you explore your options and take that next step with confidence.

Moving to Little Hulton?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

6. Moston

Avg. House Price:

£190,000

Avg. First Time Buyer Paid:

£180,000

Property Prices in Moston

The average property price here is around £190,000, with first-time buyers typically paying closer to £180,000. It’s an area where your money can still stretch further, with homes often offering more space than what you’d find closer to town, all while staying within reach of good transport links and everyday amenities.

What Will a Deposit Look Like?

For a home priced at the average first-time buyer level of £180,000 in Moston, a 5% deposit would be around £9,000. If you’re aiming for 10%, that would take you to £18,000, and a 15% deposit would be roughly £27,000.

These figures are just a starting point. What you’ll need can vary based on the property, the lender and your personal financial situation.

Type of Homes You’ll find

Moston is full of solid, red brick terraces, the kind of homes that tend to offer a lot of space at a sensible price. Many of these properties come with decent gardens and are well suited to buyers looking to settle in for the long term.

The area also has a few newer builds that have popped up over the last decade, giving buyers a more modern option if that’s what they’re after. While older homes might offer better value upfront, it’s worth keeping in mind that some may need a bit of updating or could come with restrictions around mortgage lending.

Thinking About Buying in Moston?

Moston remains a strong option for first-time buyers who want more space, more value and a good location without being too far from the centre of Manchester. If you’re thinking of making the move, our mortgage advisors in Manchester are here to help you get started with the right advice and support.

Moving to Moston?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

7. Little Hulton

Avg. House Price:

£228,000

Avg. First Time Buyer Paid:

£183,000

Thinking About Buying in Ardwick?

The average house price in Ardwick is approximately £228,000, with first-time buyers typically paying around £183,000.

This area provides an opportunity to live close to the city’s amenities without the higher price tags found in neighbouring districts.

What Will a Deposit Look Like?

For a first-time buyer purchasing at the average price of £183,000 in Ardwick, a 5% deposit would amount to approximately £9,150. Opting for a 10% deposit would require around £18,300, while a 15% deposit would be about £27,450.

These figures are estimates, and actual deposit requirements can vary based on the lender, your credit history, and the specific property.

Type of Homes You’ll find

Ardwick predominantly features traditional terraced and semi-detached houses, many of which date back to the early 20th century. These homes often offer generous living spaces and are popular among first-time buyers seeking value.

In addition to these, the area has seen some regeneration, with new developments providing modern housing options. While these newer homes may come at a premium, they offer energy efficiency and contemporary designs.

Thinking About Buying in Ardwick?

Ardwick offers affordability and a range of housing options, making it an attractive choice for first-time buyers. If you’re considering purchasing a home in the area and would like to discuss your mortgage options, our team of mortgage advisors in Manchester are here to help you navigate the process.

Moving to Ardwick?

Let us help you find a mortgage for your new home that fits your personal and financial circumstances.

Looking Beyond the Averages

Your income, deposit, credit history and even the type of home you’re looking at can all affect what a lender is willing to offer. In some areas, you might find more flexibility. In others, things like lease length or property condition could limit your options.

Even in parts of Manchester where prices are lower, it’s still worth looking at the full picture. Monthly repayments, household bills, and any future changes to your income should all be part of the plan.

If you’ve managed to save a 5% deposit and you’re wondering what that could get you, or if you’re simply not sure where to start, our mortgage advisors in Manchester are here to help. We’ll look at your budget, explain what you could borrow, and guide you through the next steps.

Date Last Edited: May 28, 2025